Blog

Do NOT Manufacture in Mexico (Until You Can Answer These 7 Questions)

### **Do NOT Manufacture in Mexico (Until You Can Answer These 7 Questions)** Every year, a new wave of companies decides that Mexico is the obvious next manufacturing destination. Lower costs. Shorter lead times. USMCA advantages. Growing industrial base. And every year, many of those projects quietly fail — not because Mexico is the wrong choice, but because the decision was made for the wrong reasons. Mexico is not a universal solution. It is not a plug-and-play replacement for Asia. It is not a shortcut. Before moving production, companies should be able to answer a few uncomfortable questions. If these questions create hesitation, delays, or internal disagreement, the problem is rarely Mexico. --- ### **1. Are You Solving a Strategic Problem — or Just Chasing Lower Labor Costs?** Cost-driven relocations without structural logic tend to collapse. Labor arbitrage alone is rarely durable. --- ### **2. Do You Actually Know Your Manufacturing Process in Detail?** Mexico has excellent manufacturers — but they are not mind readers. If tolerances, materials, quality criteria, and production logic are vague, supplier selection becomes guesswork. --- ### **3. Who Inside Your Company Owns the Mexico Project?** Successful transitions have clear internal champions. Failed transitions usually involve committees. --- ### **4. Can Your Business Survive a 6–18 Month Stabilization Period?** Nearshoring is not instant. New suppliers, new logistics, new controls — all introduce friction. --- ### **5. Are You Prepared to Visit Suppliers Repeatedly?** Remote manufacturing strategies are a fantasy. Mexico is relationship-driven. --- ### **6. Do You Need a Supplier — or Do You Need a Local Problem-Solver?** Most foreign companies underestimate how often unexpected issues arise: Engineering adjustments Quality interpretation gaps Capacity constraints Communication friction --- ### **7. Are You Comparing Mexico to Reality — or to a Perfect Scenario?** Many comparisons assume flawless execution. Real projects involve delays, revisions, and learning curves. --- ### **Closing Section** Mexico can be an extraordinary manufacturing platform. But it rewards preparation, clarity, and realistic expectations. Companies that succeed rarely ask, “Is Mexico cheaper?” They ask, “Is Mexico structurally smarter for our supply chain?” If you are evaluating manufacturing options in Mexico and want a reality-based discussion rather than a sales pitch, Nearshore Mexico Sourcing works with companies at the decision stage — when mistakes are still inexpensive.

Read More

2026: The Year Companies Must Execute Their Nearshoring Strategy in Mexico

*Why North American supply chains can’t afford another year of waiting* For years, nearshoring to Mexico was a strategic idea. A topic for board meetings, white papers, and consulting sessions. Executives knew supply chains needed to become shorter, faster, and more resilient, but the urgency wasn’t always there. In 2023 and 2024, companies explored Mexico. In 2025, momentum accelerated dramatically. Now, as we move into **2026**, the picture is unmistakably clear: **This is no longer the year to *discuss* nearshoring — it’s the year to *execute* it.** The turning point has arrived. Supply chain risks have multiplied, supplier capacity in Mexico is tightening, new U.S. regulations are pushing companies away from China, and customers increasingly expect short lead times and North American-based production. The companies that move in early 2026 will secure supplier capacity, engineering alignment, and onboarding timelines. The companies that wait another year will be fighting over what remains. This article explains **why 2026 is the decisive year for nearshoring to Mexico**, what forces are driving companies to make the move now, and how to execute a nearshoring project efficiently and successfully. --- ## **1. 2025 Changed the Global Manufacturing Map — Permanently** The past year reshaped supply chains more than any period since 2020. What we saw in 2025 wasn’t temporary turbulence: it was structural change. ### **A. Trade pressure on China reached its highest level in years** Throughout 2025, the U.S. increased tariffs and regulatory pressure on a wide range of Chinese imports: * Steel and aluminum components * Electrical equipment * Plastics and molded parts * Machinery and metal assemblies Even companies not directly targeted felt the impact through higher costs, longer customs checks, and client pressure to reduce China exposure. Executives realized something important: **China risk is no longer theoretical — it is financial, operational, and commercial.** ### **B. Logistics volatility proved it’s not going away** Shipping stabilized after the pandemic… until it didn’t. In 2025, companies again faced: * Delays caused by the Panama Canal drought * Vessel re-routing due to Red Sea attacks * Rising insurance premiums * Limited carrier reliability A single event anywhere in the world can still disrupt a 30-day supply chain from Asia. This vulnerability simply doesn’t exist with Mexico. ### **C. Mexico’s industrial ecosystem hit a new level of maturity** Mexico made more progress in 2025 than any recent year: * More CNC capacity * More plastics injection and extrusion suppliers * Increased automation in metal fabrication * New investment from automotive, electronics, and aerospace companies * A growing technical workforce The network of suppliers is stronger than ever — but demand is outpacing capacity. ### **D. U.S. clients now actively *push* suppliers to reduce China dependence** In 2025, an important shift happened: **Customers began requiring their U.S. suppliers to diversify production.** For many mid-sized American companies, this pressure was the final trigger forcing them to seriously pursue Mexico. --- ## **2. Why 2026 Is the Year of Execution, Not Discussion** Executives have enough data, enough examples, and enough warnings. The time for exploration is over. 2026 will be defined by five forces that make nearshoring unavoidable. ### **A. Supplier capacity in Mexico is tightening fast** Throughout 2025, Mexico saw: * Record demand for CNC machining * Overloaded metal fabrication shops * Injection molders working near full capacity * Lead times for tooling increasing * New customers outpacing available machine hours The companies that start sourcing in early 2026 will secure space in the best factories. The companies that wait until late 2026 will face: * Longer onboarding * Higher MOQs * Delayed engineering support * Slower lead times The Mexico window is open — but it will not stay wide open forever. ### **B. U.S. manufacturers can no longer justify China’s lead time risk** Customers demand shorter lead times. Distributors want faster replenishment. Large buyers want lower safety stock. A 30–35 day ocean transit simply does not fit the new operational reality. Nearshoring cuts: * Delivery time from 30+ days to 2–6 days * Inventory requirements * Cash flow cost tied to ocean freight * Customer frustration 2026 is the first year where **speed outvalues low labor cost** for most industrial categories. ### **C. New U.S. regulations reward North American production** Emerging policies around: * Critical minerals * Electronic components * Industrial machinery * Auto parts * Metal components …increasingly favor suppliers with **North American origin**. These trends will intensify in 2026 regardless of political changes. Nearshoring is becoming less of an option and more of a competitive requirement. ### **D. Companies that wait will lose negotiation leverage** In 2023–2024, suppliers in Mexico chased customers. In 2025, the balance shifted. In 2026, the best suppliers will **choose** their customers. The earlier you move, the better your terms, delivery, pricing, and strategic attention. ### **E. A new competitor reality: your rivals are already sourcing in Mexico** We are seeing a strategic shift: * Mid-sized U.S. manufacturers * Industrial OEMs * Contract manufacturers * Private equity-backed groups These companies are actively transferring parts, assemblies, and even full product lines to Mexico. Not moving now means falling behind. --- ## **3. The New Profile of Companies Nearshoring in 2026** Nearshoring is no longer driven only by large corporations. In 2026, the fastest-growing group is: ### **Small and mid-sized U.S. manufacturers with 50–300 employees** These companies are particularly vulnerable to: * Long lead times * High MOQs in China * Cash flow pressure * Volatile shipping rates * Quality issues that take months to correct For them, Mexico is not a strategic luxury — it is a practical solution. We consistently work with companies that need: * CNC-machined parts * Welded assemblies * Stamped or laser-cut metal * Plastics injection or extrusion * Sub-assembly and product assembly * Custom equipment fabrication This segment of the market is driving nearshoring demand faster than ever before. --- ## **4. The Top Misconceptions That Still Slow Companies Down** Despite the urgency, many companies hesitate due to outdated assumptions. ### **“Mexico is only good for simple production.”** Not anymore. Mexico now produces: * Precision machined components * Automotive-grade assemblies * Aerospace structures * Complex plastics * Electrical and electronic components ### **“Nearshoring is too risky.”** In reality, the risks of staying offshore are now higher. ### **“Finding suppliers is easy — we’ll just Google them.”** This approach is responsible for 80% of failed nearshoring attempts. Mexico has incredible capability, but finding the *right* partner requires on-the-ground knowledge and vetting. ### **“We’ll move everything at once.”** Successful nearshoring is incremental: 1. Small initial projects 2. First articles 3. Adjustments 4. Scale Trying to transfer an entire product line at once is unnecessary and risky. --- ## **5. The Hidden Advantages of Nearshoring That Most Companies Underestimate** Beyond cost and logistics, nearshoring unlocks benefits that executives often don’t foresee until after implementation. ### **A. Faster engineering collaboration** When your engineers can fly to a factory in Monterrey, Guadalajara, or Querétaro in a single day, everything changes: * Faster prototyping * Faster corrections * Faster iteration * Higher alignment This is nearly impossible with Asia. ### **B. Less inventory, healthier cash flow** Removing 30 days of shipping and customs clearance can reduce inventory needs by 30–60%. For many companies, this is more impactful than labor savings. ### **C. More stable quality** Proximity enables: * Frequent audits * Easier communication * Quick corrective action * Better trust Quality issues that once took months to resolve can now be fixed in days. ### **D. Reduced environmental impact** Shorter transportation distances help companies meet ESG targets without major operational change. --- ## **6. A Practical Roadmap for Nearshoring in 2026** Companies that succeed in Mexico follow a structured method. Here is the roadmap we use with clients: ### **Step 1. Define scope** Identify which parts or processes offer the best nearshore benefit: * Cost * Lead time * Customer impact * Complexity Not everything should move — start with the right items. ### **Step 2. Identify and vet suppliers** This is where failure typically occurs. Vetting must include: * Equipment list * Certifications * Export experience * Management culture * Financial stability * Technical capability * Communication quality Local, in-person validation is essential. ### **Step 3. Technical review and pilot production** This includes: * Drawing review * Material spec confirmation * First article samples * Engineering feedback * Process adjustments A disciplined technical stage prevents problems later. ### **Step 4. Scale gradually** Begin increasing volumes only after the pilot phase is stable. ### **Step 5. Build long-term collaboration** This includes: * Weekly follow-up * Clear KPIs * Bilingual documentation * Periodic factory visits Nearshoring works best when treated as a partnership, not a transaction. --- ## **7. Why Many U.S. Companies Choose Nearshore Mexico Sourcing** By late 2025, we saw a surge of U.S. companies needing hands-on assistance — not just supplier lists. Companies want: * Real validation * Real communication support * Real technical guidance * Real follow-up * On-site presence * Support during production and startup We help clients: * Find reliable Mexican suppliers * Vet and validate capabilities * Manage communication and expectations * Review drawings, materials, feasibility * Support during manufacturing, commissioning, and start-up * Reduce risk and accelerate results Our clients typically save months of trial-and-error and avoid expensive missteps. --- ## **8. The Cost of Waiting Until 2027** Delaying nearshoring another year will have consequences: * Higher competition for supplier capacity * Longer onboarding timelines * Less favorable pricing * Slower engineering response * Lost competitive advantage * Greater exposure to tariffs and geopolitical disruptions 2026 is the year where **being early matters.** --- # **Conclusion: 2026 Is the Execution Year** The global supply chain environment has changed permanently. The companies that lead in 2026 will be the ones that: * Move production closer to home * Strengthen resilience * Improve delivery times * Reduce dependency on China * Build long-term partnerships in Mexico The companies that delay will find themselves reacting instead of planning — and competing for limited space in Mexico’s rapidly growing industrial ecosystem. As we enter 2026, one message is clear: **The window of opportunity is open, but not for long. This is the year to act. Not to explore — to execute.** ---

Read More

Why 2025 Is a Breakthrough Year for Nearshoring in Mexico — And Why U.S. Companies Can’t Afford to Miss It

# **Why 2025 Is a Breakthrough Year for Nearshoring in Mexico — And Why U.S. Companies Can’t Afford to Miss It** Nearshoring is no longer a trend. In 2025, it has become one of the strongest economic forces reshaping North American manufacturing. Despite global uncertainty, Mexico continues to attract record levels of foreign investment, new industrial parks, and expanded production capacity. For U.S. companies evaluating alternative supply chains, Mexico has become the **top strategic destination** — and the momentum is only accelerating. At Nearshore Mexico Sourcing, we work directly with American companies that want to reduce dependence on Asia, shorten lead times, and gain visibility and control over their supplier base. The recent surge in positive news for Mexico reinforces what we see every day on the ground: **The window of opportunity has never been better.** Here is what is driving it — and why it matters for you. --- ## **1. Foreign Direct Investment in Mexico Hits New Highs** 2025 opened with a wave of announcements from global manufacturers expanding operations in Mexico. Automakers, electronics producers, metal fabricators, packaging companies, and industrial suppliers are all doubling down on North America. Large U.S. corporations are publicly reporting that relocating part of their supply chain to Mexico has: * Reduced logistics costs * Reduced geopolitical exposure * Improved inventory turnover * Shortened product development cycles * Increased reliability and speed-to-market This growth translates into **stronger supplier ecosystems**, more qualified manufacturers, and expanded capabilities in CNC machining, metal fabrication, plastics, electronics, packaging, and specialized assemblies. --- ## **2. New Government Incentives for Nearshoring** Mexico recently rolled out new incentive programs designed specifically to attract U.S. companies. These programs support: * Investment in fixed assets * Expansion of industrial capacity * Workforce upskilling * Modernization of local factories * Regional integration across North America For U.S. companies, this means **lower setup costs** and a smoother landing when shifting production to Mexico. Combined with USMCA benefits, the regulatory environment is now more favorable than at any time in the last decade. --- ## **3. Nearshoring Is Reshaping North American Supply Chains** Multiple U.S. industries are now actively relocating or duplicating capacity in Mexico: * Automotive & EV components * Consumer electronics * Industrial machinery * Packaging & plastics * Home goods & appliances * Logistics and warehousing * Food processing equipment * Metalworking and precision manufacturing The reasoning is consistent: **Shorter supply chains = faster decisions + stronger resilience + more competitive pricing.** American companies that start their transition now gain a first-mover advantage in supplier selection, capacity reservation, and long-term pricing. --- ## **4. Mexico Offers What Asia No Longer Can: Speed, Proximity, and Transparency** Lead times are now one of the most decisive competitive factors. While Asia still offers low-cost production, long maritime transit times and geopolitical volatility have become major risks. By contrast, Mexico offers: * **1–5 day trucking times** to the U.S. * Direct communication with suppliers in real time * Easier quality audits * Rapid prototyping * Faster corrective actions * Aligned time zones * Cultural and regulatory compatibility with U.S. businesses Companies that need agility simply perform better with suppliers located closer to home. --- ## **5. The Challenge: Finding Reliable Manufacturers in Mexico** The only real obstacle U.S. companies consistently report is the same: **“We don’t know which Mexican suppliers are reliable.”** Unlike China, where enormous online marketplaces centralize suppliers, Mexico’s industrial ecosystem is fragmented and often invisible from abroad. Many of the best factories: * Don’t appear on Google * Don’t have websites in English * Don’t respond to cold inquiries * Don’t publish capabilities online * Don’t know how to quote U.S. customers properly * Don’t accept international payment terms * Don’t communicate clearly That is exactly where Nearshore Mexico Sourcing becomes essential. --- # **How Nearshore Mexico Sourcing Helps U.S. Companies Succeed** We act as **your boots on the ground**, bridging your company with vetted, trustworthy Mexican manufacturers in multiple sectors. ### What we do: * Identify and evaluate factories that match your needs * Conduct in-person visits and capability audits * Validate quality systems, equipment, and certifications * Negotiate pricing and terms in your favor * Mitigate communication, cultural, and operational risks * Oversee production, lead times, KPIs, and quality * Coordinate logistics and export processes * Provide ongoing supplier management ### What you gain: * Reliable sourcing without flying to Mexico * Lower supply chain risk * Transparent reporting * Faster project execution * Access to vetted suppliers you could not find online * A partner who protects your interests inside Mexico We work for **you**, not for the factories. --- ## **Why This Matters in 2025** With record investment flowing into Mexico, supplier capacity is filling fast. American companies moving early can still secure reliable partners, competitive pricing, and long-term production slots. Those who wait will face: * Longer lead times * Limited availability * Higher prices * Reduced choice among qualified suppliers The timing is exceptional — and the companies that take action now will lead the next decade of North American manufacturing. --- # **Conclusion: Mexico Is the Future of North American Supply Chains** If your company is considering nearshoring, this is the moment to act. Mexico offers the combination of cost efficiency, strategic proximity, industrial capability, and stability that U.S. manufacturers have been seeking for years. Nearshore Mexico Sourcing is here to guide you through every step — from supplier identification to ongoing production support. **If you want a trusted partner in Mexico who works 100% for your interests, we’re ready to help.**

Read More

Mexico’s Industrial Clusters: Where to Manufacture and Why It Matters

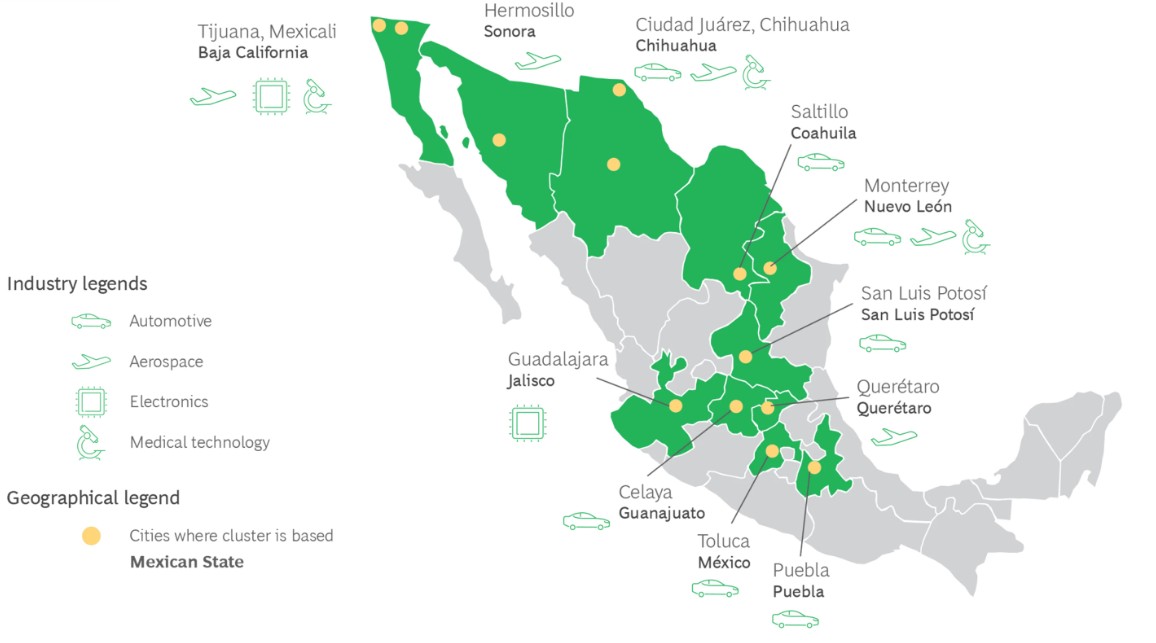

## 🌎 Mexico’s Industrial Clusters: Where to Manufacture and Why It Matters When companies consider nearshoring to Mexico, one of the first questions is: *where* should we manufacture? The answer depends on your industry, because Mexico has developed specialized **industrial clusters** that concentrate suppliers, logistics, and talent in specific regions. These clusters are what make Mexico one of the most strategic manufacturing destinations in the world. --- ### 🚗 Automotive and Auto Parts – Bajío Region (Guanajuato, Querétaro, Aguascalientes) The Bajío region is Mexico’s Detroit. Global OEMs like **GM, Toyota, Mazda, Honda, and Volkswagen** have major plants here, surrounded by hundreds of Tier-1 and Tier-2 suppliers. Strong logistics networks connect the area to the U.S. border and major ports. If you are looking to source **metal parts, stamping, injection molding, harnesses, or assemblies**, this region offers the deepest supplier base in the country. --- ### ✈️ Aerospace – Querétaro and Chihuahua Mexico’s aerospace industry has exploded over the past two decades. Querétaro, in particular, is home to **Bombardier, Safran, Airbus, and Delta Maintenance**, supported by world-class technical universities and certified MRO facilities. Chihuahua complements this with **precision machining, sheet metal fabrication, and wire harness production** for aerospace and defense. --- ### 💻 Electronics and Appliances – Jalisco and Baja California **Guadalajara**, known as Mexico’s “Silicon Valley,” leads in electronics manufacturing and design. Multinationals such as **Flex, Jabil, HP, and Intel** operate here, alongside hundreds of local SMEs producing PCBs, cable assemblies, and enclosures. Meanwhile, **Tijuana** is a hub for **consumer electronics and white goods**, thanks to its proximity to San Diego and access to both the U.S. and Pacific markets. --- ### 🍽️ Food Processing and Packaging – Central and Northern Mexico Mexico’s food industry is booming, with demand for **packaging automation, autoclaves, filling lines, and labeling systems**. Key regions include **Nuevo León, Estado de México, and Jalisco**, which combine agricultural production with modern industrial infrastructure. --- ### 🔩 Metalworking and Heavy Industry – Monterrey and Coahuila **Monterrey** remains the country’s powerhouse for **steel, machining, foundries, and fabrication**. Global manufacturers like **Ternium, Frisa, and John Deere** operate here, and a strong base of medium-sized workshops supports quick prototyping and small-batch production. --- ### 🌱 Why Clusters Matter for Nearshoring Industrial clusters offer: * Access to **qualified suppliers** in a defined radius * **Reduced logistics costs** and lead times * Strong **supply chain ecosystems** (heat treatment, coatings, tooling, etc.) * Availability of **skilled engineers and technicians** For foreign companies, selecting the right region is key to achieving **competitive landed costs** and **stable production quality**. --- ### 🤝 How Nearshore Mexico Sourcing Can Help At **Nearshore Mexico Sourcing**, we help international companies: * Identify **the right region and supplier cluster** for their product line * Conduct supplier validation, audits, and price benchmarking * Support legal and operational setup (“**soft landing**”) * Manage bilingual communication, RFQs, and quality follow-up Our goal is simple: make sourcing and manufacturing in Mexico **easy, transparent, and cost-effective**. --- 📞 **Let’s talk about your project** Visit [www.nearshoremexicosourcing.com](https://www.nearshoremexicosourcing.com) or write to us to explore how we can connect you with the right supplier network in Mexico. --- Tags: manufacturing in Mexico, sourcing specialist, soft landing, supplier audit, industrial clusters, nearshoring, sourcing agent, sourcing consultants

Read More

Why more U.S. Companies Choose Mexico for Manufacturing, and How a Sourcing Specialist Can Make the Different

Why More U.S. Companies Choose Mexico for Manufacturing — and How a Sourcing Specialist Can Make the Difference 🧭 The Shift from “Made in China” to “Made in Mexico” Over the past few years, companies across North America have been rethinking their supply chains. Rising freight costs, tariffs, and long lead times from Asia have pushed many purchasing managers to explore manufacturing in Mexico. The advantages are clear: ✅ Lower logistics costs ✅ USMCA benefits ✅ Cultural and time zone proximity However, finding the right supplier can be challenging — from language barriers to inconsistent quality standards. That’s where Nearshore Mexico Sourcing comes in. ⚙️ What We Do: From Search to Shipment At Nearshore Mexico Sourcing, we help international companies find, evaluate, and launch partnerships with qualified Mexican suppliers. Our bilingual team acts as your local sourcing specialist in Mexico, bridging the gap between global expectations and local capabilities. Our core services include: 🔍 Supplier identification and screening 📊 Price and capability benchmarking 🏭 Factory audits and sample coordination 📐 Technical and quality evaluations ✈️ Soft-landing support for site visits or new operations In short — we do the legwork in Mexico, so you can focus on growing your business. 🏢 Case Study: Helping a Fortune 500 Company Nearshore Successfully One of our recent projects involved a Fortune 500 industrial group relocating part of its sheet-metal assembly production from China to Mexico. Their challenge: Find a reliable metal-mechanic supplier capable of delivering high-quality assemblies with just-in-time logistics. Within six weeks, we: ✅ Identified and pre-qualified 12 potential suppliers in Central Mexico ✅ Conducted on-site audits and evaluations ✅ Shortlisted two finalists ✅ Coordinated first-article samples and DFM reviews ✅ Supported price negotiations and USMCA documentation Result: The client reduced logistics time from 45 days to just 3 days and saved over 18% on total landed cost — all while strengthening supply chain resilience. 🤝 Why Work with a Sourcing Specialist in Mexico? Many companies underestimate the importance of having a local presence. In Mexico, relationships, communication, and follow-up are everything. Partnering with a trusted sourcing agent means you avoid: 🚫 Miscommunication and delays 🚫 Overpriced intermediaries 🚫 Hidden costs and unreliable suppliers Our bilingual sourcing team combines engineering, procurement, and quality control experience across the automotive, plastics, and assembly industries. We understand both U.S. corporate standards and Mexican manufacturing culture — a rare but powerful mix. 🌎 Soft-Landing Services for a Smooth Start If your company is considering nearshoring to Mexico, we also offer soft-landing support to make your transition seamless: ✈️ Site visit coordination and local logistics 🏢 Business setup introductions (legal, tax, HR) 👥 Temporary office or local team support 📚 Cultural and negotiation guidance Think of us as your bridge between the U.S. and Mexico — making your entry into Mexican manufacturing safe, structured, and efficient. If your company is exploring sourcing or manufacturing in Mexico, let’s talk. 👉 Visit www.nearshoremexicosourcing.com to discuss your project — we’ll help you find the right partner and make your nearshoring strategy a success.

Read More

7 Common Mistakes When Nearshoring to Mexico — and How to Avoid Them

### **Introduction** Nearshoring to Mexico has become a top strategy for companies that want to **reduce dependency on China** and bring production closer to the U.S. market. With the advantages of the **USMCA trade agreement**, competitive labor, and strong manufacturing clusters, Mexico is attracting attention from every industry — from automotive and plastics to food processing and electronics. However, the transition is not always smooth. Many companies underestimate how different it is to **source products in Mexico** or to **move manufacturing to Mexico** compared to Asia or the U.S. As a **sourcing agent and consultant in Mexico**, we’ve seen what works — and what doesn’t. Below are the seven most common mistakes companies make when starting a **nearshoring or soft-landing project in Mexico**, and how to avoid them. --- ### **1. Treating Mexico Like “the Next China”** Mexico is not a low-cost copy of China. The manufacturing landscape here is based on **medium-sized, often family-owned companies** that value personal relationships, flexibility, and reliability over volume and price. If you treat local suppliers like anonymous factories on Alibaba, you’ll quickly lose traction. **Tip:** Approach Mexico with a partnership mindset. It’s about **collaboration and trust**, not only cost. A good **sourcing consultant in Mexico** will help bridge the gap between your expectations and local business culture. --- ### **2. Overlooking Regional Strengths** Mexico is vast and diverse. Monterrey is known for metalworking and industrial automation, Guadalajara for electronics and plastics, Querétaro for aerospace and automotive, and León for leather and textiles. Choosing the wrong region can add cost and complexity. **Tip:** Work with a **nearshore agent or sourcing expert** who understands regional ecosystems. At Nearshore Mexico Sourcing, we match each project with the right manufacturing cluster and supplier base to save time and money. --- ### **3. Assuming Proximity Automatically Means Speed** Many companies believe that because Mexico is close to the U.S., delivery will be instant. But if your local supplier imports steel from Korea or resins from China, you’re still tied to global logistics. Customs procedures, holidays, and communication style also play a role. **Tip:** Before launching production, **map the full supply chain** — including imported materials. An experienced **sourcing agent in Mexico** can help verify local content and minimize lead-time surprises. --- ### **4. Weak Communication and Follow-Up** In Mexico, relationships are everything. Projects move forward through consistent communication, personal visits, and ongoing follow-up. Many U.S. or European buyers lose momentum because they rely solely on email and expect immediate replies. **Tip:** Communicate regularly by phone or WhatsApp, and confirm key points in writing. If you don’t have local presence, hire a **sourcing consultant or nearshore agent in Mexico** to represent your interests face-to-face. --- ### **5. Skipping Legal, Fiscal, and Import Procedures** Mexico’s trade framework is powerful, but complex. Programs like **IMMEX** or **Prosec** can save huge costs — if handled correctly. Without proper structure, companies face issues with **VAT refunds, import licenses, or labor compliance.** **Tip:** Before moving production to Mexico, consult experts in **soft landing services** and **manufacturing transfer support**. Setting up contracts, tax IDs, and import procedures properly will prevent long delays and unnecessary costs. --- ### **6. Neglecting On-Site Quality Control** Even experienced manufacturers make the mistake of assuming everything will go smoothly after a few sample photos. Quality assurance in Mexico must be proactive. **Tip:** Arrange **factory audits and production inspections** through a trusted **sourcing agent or local quality partner**. This ensures specifications, tolerances, and timelines are respected from prototype to shipment. --- ### **7. Believing Labor Is Always “Cheap”** Yes, Mexico offers competitive wages — but labor is only one part of the equation. In areas like Monterrey, Querétaro, or Guadalajara, skilled workers are in high demand, and turnover can increase total costs. **Tip:** Focus on long-term supplier relationships. Stability, training, and collaboration usually lead to better quality and lower total cost than chasing the lowest quote. --- ### **Conclusion** Mexico is the ideal nearshoring destination for companies that want **resilient, regional supply chains** — but success depends on local understanding. Avoiding these common mistakes can save your project months of frustration and thousands of dollars. Working with a **sourcing expert in Mexico** gives you a major advantage. At **Nearshore Mexico Sourcing**, we provide complete support — from **supplier scouting and audits** to **manufacturing transfer, contract negotiation, and soft-landing services** for companies moving production to Mexico. If you’re exploring **how to move production to Mexico** or need a reliable **sourcing consultant**, contact us today. We’ll make sure your nearshoring project starts strong and stays on track.

Read More

From Global to Local: Why Mexico Is the US’ Most Reliable Supply Chain Ally

For decades, companies around the world have relied on extended global supply chains to keep costs down and maximize efficiency. A production cycle that once seemed seamless—design in one country, manufacturing in another, assembly somewhere else, and shipping across oceans—was long considered the gold standard of globalization. But today, the world looks very different. Geopolitical tensions, ongoing wars, trade disputes, and inflation have reshaped the way businesses think about sourcing and manufacturing. The lesson is clear: companies can no longer depend solely on distant suppliers. They need local allies who can react quickly, adapt to demand, and provide stability when the global system is under pressure. **The Shift From Global to Local** Waiting weeks—or even months—for a container to arrive from overseas is no longer acceptable in fast-moving industries. Businesses need to protect themselves against bottlenecks, rising freight rates, and unexpected disruptions such as port closures or political conflict. That’s why many US companies are shifting their perspective. Instead of asking, “Who can make it cheapest in the world?”, the question has become: “Who can make it fastest, reliably, and close to home?” Local suppliers can offer: - Agility. The ability to react to demand spikes in real time. - Speed. A truck on the road and goods in hand in less than a week, not months. - Value. While local production may not compete with the lowest Chinese prices, it often delivers far better costing than US or Canadian alternatives—especially in labor-intensive sectors. **Mexico: A Partner for Over 200 Years** Mexico is not just the closest option—it is the most natural ally of the United States. For over 200 years, Mexico and the US have shared not only a border but also one of the most important economic partnerships in the world. This relationship is more than trade agreements or policy—it is built on geography, shared goals, and mutual dependence: For the US: Mexico provides cost-effective manufacturing, skilled labor, logistical speed, and immediate access to North American markets. For Mexico: The US remains its largest trading partner, offering constant demand, investment, and advanced technology. This balance of needs ensures that the partnership is not one-sided. The US needs Mexico just as Mexico needs the US. And in times of global uncertainty, that interdependence becomes an unmatched strategic advantage. **Looking Ahead** The global supply chain may never return to what it was before. But that’s not necessarily a loss—it’s an opportunity. For US companies, strengthening ties with Mexican suppliers means faster deliveries, competitive costs, and reliable partnerships that can withstand the volatility of today’s economy. It’s time to stop thinking of globalization as the only answer. The real solution is local partnerships with global impact. And in this new reality, no partnership is more important than the one between Mexico and the United States.

Read More

Why Companies Need Dual Sourcing With Mexico As Plan B

# Why Companies Need a Dual Sourcing Strategy with Mexico as Plan B Global supply chains are more interconnected—and more fragile—than ever. For companies that rely heavily on China for their sourcing and manufacturing, the risks are increasingly visible. Sudden tariffs, shifting shipping routes, unpredictable freight rates, and broader geopolitical tensions all create uncertainty. Many organizations have already felt the pain of these disruptions, yet few have developed a solid **Plan B**. That’s where Mexico enters the picture. ## The Case for Dual Sourcing Relying on a single country—even one as capable as China—creates concentration risk. Dual sourcing, or building a secondary supply base in another geography, reduces that exposure. By having qualified suppliers in Mexico, companies create resilience: if one sourcing channel is disrupted, they can shift capacity to the other. But there’s more to dual sourcing than simply “adding another vendor.” It requires forward-looking planning, long before a crisis hits. ## Why Mexico, Why Now? Mexico is not China—and that’s both a challenge and an opportunity. Building supplier relationships in Mexico takes time. Projects must be nurtured properly; trust and alignment don’t happen overnight. The best moment to start this journey is **now**, while there’s still breathing room. When geopolitical shifts occur, when tariffs spike overnight, or when shipping rates double without warning, companies worldwide scramble at the same time to find alternatives. Mexican suppliers’ project and quotation teams quickly become overloaded in those moments, leaving newcomers at the back of the line. Getting ahead of the curve means securing capacity and relationships **before** the storm hits. ## Beyond Risk Mitigation: The Advantages of Mexico While hedging against sourcing risks is critical, Mexico also offers clear, ongoing advantages: * **Proximity**: Short flights from the U.S. make visits, audits, and collaboration much easier. * **Time Zone Alignment**: Working in (practically) the same time zone enables real-time communication, without the long delays caused by Asia’s time difference. * **Reduced Lead Times**: Delivery cycles are measured in days or weeks, not months. * **Lower Inventory Levels**: Faster shipments mean companies can carry less buffer stock, freeing up working capital. * **USMCA Advantages**: Trade agreements provide additional stability and tariff relief within North America. Together, these factors make Mexico more than just a fallback option—they position it as a strategic sourcing partner. ## A Strategic Hedge for the Future Geopolitical risks are unpredictable, but one thing is certain: they won’t disappear. Whether it’s tariffs, trade disputes, pandemics, or shipping bottlenecks, supply chains will continue to face shocks. Companies that prepare now—by building dual sourcing strategies and investing in Mexican supplier relationships—will be the ones that stay resilient. Waiting until the next disruption hits will be too late. Now is the right moment to act.

Read More

Precision Manufacturing in Mexico’s Industrial Heartland

Mexico has long been a global hub for precision manufacturing, and nowhere is this more evident than in its central and northern industrial corridors. Cities like **Monterrey**, **San Luis Potosí**, **Aguascalientes**, **Querétaro**, and **Celaya** have built a strong reputation for their ability to deliver high-quality, cost-effective components for demanding industries worldwide. From **spindle CNC machining** and **Swiss-type lathes** to **weldments**, **steel and tube bending**, and a wide range of **surface finishing techniques**, these regions host a dense network of suppliers with the expertise, infrastructure, and commitment to quality that global OEMs require. --- ## Strategic Locations for Global Supply Chains * **Monterrey, Nuevo León** – Known as Mexico’s industrial powerhouse, Monterrey boasts a highly developed metal-mechanic sector. Manufacturers here specialize in high-precision CNC machining, Swiss-type lathe production, and large-scale weldments for industries like automotive, oil & gas, and heavy equipment. * **San Luis Potosí (SLP)** – A key automotive manufacturing hub, SLP offers world-class machining, metal fabrication, and finishing services. Its central location provides excellent logistics connectivity to both U.S. markets and Mexico’s seaports. * **Aguascalientes** – Home to a strong automotive cluster, Aguascalientes is renowned for its skilled workforce in CNC parts, precision assemblies, and lean manufacturing processes. * **Querétaro** – One of the fastest-growing aerospace and automotive regions in Mexico, with advanced capabilities in tube bending, weldments, and complex assemblies. * **Celaya, Guanajuato** – Strategically located in the Bajío region, Celaya is an important player in steel fabrication, surface treatments, and parts for household appliances, electronics, and industrial machinery. --- ## Capabilities to Meet Global Standards Suppliers in these regions are equipped with modern facilities and the latest technology, including: * **Spindle CNC Machining** – Producing precision components with tight tolerances for high-performance applications. * **Swiss-Type Lathes** – Ideal for small, complex parts used in automotive, electronics, and medical devices. * **Weldments** – Fabricating structural assemblies with MIG, TIG, and robotic welding technologies. * **Steel & Tube Bending** – Creating complex shapes for frames, enclosures, and structural components. * **Surface Finishing Techniques** – Including powder coating, anodizing, electroplating, polishing, and painting, ensuring both functionality and aesthetics. --- ## Serving Diverse Industries The manufacturing expertise in Monterrey, SLP, Aguascalientes, Querétaro, and Celaya supports a wide spectrum of industries: * **Automotive & Heavy Equipment** – Engine components, chassis parts, and assemblies. * **Electronics** – Precision housings, connectors, and heat sinks. * **Household Appliances** – Structural frames, panels, and decorative finishes. * **Aerospace & Energy** – High-strength, lightweight components and specialized weldments. --- ## Why Source from Mexico’s Industrial Regions? * **Proximity to the U.S. & Canada** – Shorter lead times and reduced shipping costs under the USMCA agreement. * **Skilled Workforce** – Technically trained labor force with decades of experience in advanced manufacturing. * **Competitive Costs** – High-quality production at globally competitive rates. * **Strong Supplier Ecosystem** – Clustered industries allow for integrated solutions, from raw material processing to final assembly. --- **Nearshore Mexico Sourcing** works directly with trusted, proven suppliers in these regions, ensuring that our clients receive high-quality products, on time, and at the right cost. Whether you need complex CNC parts, custom weldments, or high-volume production runs, we help you navigate Mexico’s industrial landscape and connect you with the right manufacturing partner.

Read More

Why Global Companies Are Turning to Mexico for Manufacturing

As global supply chains continue to shift, more and more companies around the world — from Canada and Europe to Japan, Korea, Australia and New Zealand — are exploring Mexico as a strategic manufacturing base. Whether you’re looking to export to the United States under favorable USMCA terms, or to establish a foothold in Mexico and Latin America, the country offers a compelling mix of location, trade access, and long-term potential. Mexico: Your Gateway to North and Central America Located right next to the world’s largest economy, Mexico offers direct land access to the U.S. market, making it a powerful alternative to offshore production hubs. Through the US-Mexico-Canada Agreement (USMCA), goods manufactured in Mexico can enter the U.S. and Canada tariff-free, provided they meet regional content rules — a significant cost advantage for companies shipping finished products across North America. And Mexico is more than just a backdoor to the U.S. It’s a growing consumer market in its own right, with over 130 million people and rising demand for high-quality products. From there, companies can also reach Central America and the Caribbean with minimal logistics cost. Key Advantages for Global Companies 🌍 Access to North American Markets Mexico offers direct integration into U.S. and Canadian supply chains, with easier compliance under USMCA than other low-cost countries. 🕓 Shorter Lead Times, Less Risk Unlike trans-Pacific routes, Mexican logistics are faster and more predictable — by truck, train, or air — without the ocean freight volatility or port bottlenecks. 🔧 Skilled Labor, Industrial Expertise Mexico has a mature manufacturing sector, especially in automotive, electronics, packaging, plastics, metalwork, and textiles — with decades of experience serving international clients. 📞 Time Zone and Communication Alignment For companies in Europe or Asia-Pacific, Mexico offers workday overlap with U.S. headquarters and smoother project management for North American rollouts. 🤝 Long-Term Partnerships, Not Just Price Mexican suppliers tend to value long-term collaboration and mutual growth over short-term profits. Once trust is built, relationships last — and that's hard to find elsewhere. Why You Shouldn’t Wait Developing a supplier in Mexico takes time and care — but those who start now will be ahead of the curve. Companies that wait until global pressures force a shift may find themselves scrambling for capacity in a competitive landscape. At Nearshore Mexico Sourcing, we help global companies identify, evaluate, and build relationships with reliable Mexican manufacturers. Whether you're relocating production from Asia, entering the Americas, or looking for a secondary supply source, we’re here to help. Ready to explore Mexico? Let’s talk.

Read More

Why Dual Sourcing with Mexico Is No Long Just Smart - It's Essential

In today’s unpredictable geopolitical environment, relying on a single source of supply has become a risk that many companies can no longer afford to take. Trade tensions, rising tariffs, port congestion, and fluctuating shipping rates — especially across the Pacific — have made global supply chains increasingly fragile. That’s why dual sourcing has moved from a "nice-to-have" to a strategic imperative. The New Global Reality For decades, China has been the go-to manufacturing hub for companies worldwide. But recent years have shown the vulnerability of that model. Political instability, pandemic ripple effects, and rising protectionist policies have created uncertainty — especially for U.S. businesses. Enter Mexico. Why Mexico Should Be Your Second Source — or Even Your First Sourcing from Mexico provides several key advantages: ✅ Shorter Lead Times – Products can move overland to the U.S. in days, not weeks or months. ✅ Stable & Predictable Shipping Costs – Say goodbye to container rate volatility and port delays. ✅ Easy Communication – Overlapping time zones, cultural proximity, and fewer language barriers make coordination more efficient. ✅ A Relationship-Based Culture – Unlike transactional supply models, Mexican manufacturers often focus on long-term partnerships. Once trust is built, you’ll find a level of commitment that’s hard to replicate. But It’s Not “Plug and Play” Let’s be honest — Mexico is not China. The ecosystem is different, and development may take longer. Companies used to China’s speed and scale may need to adjust expectations. But that patience pays off. If you invest in building a strong relationship with a Mexican supplier, you’re not just getting a vendor — you're gaining a partner for life. Get Ahead of the Curve With U.S.-Mexico-Canada Agreement (USMCA) frameworks in place, and Mexico actively seeking strategic alliances beyond the U.S., the opportunity to diversify your sourcing strategy is now. At Nearshore Mexico Sourcing, we help companies like yours connect with reliable, vetted Mexican manufacturers. If you're exploring a dual sourcing strategy — or if you're simply looking to make your supply chain more resilient — now is the time to start the conversation. Contact us today. Let’s build something that lasts.

Read More

Bridging Global Business with Mexican Opportunities

In the dynamic world of international business, Nearshore Mexico Sourcing has emerged as a key player, helping foreign companies navigate the complexities of developing suppliers and executing projects in Mexico. Founded in 2021, this Mexico-based company specializes in providing tailored solutions for businesses looking to establish a foothold in one of the most promising markets in Latin America. With their expertise in supplier development, project management, and soft landing services, NMS is redefining how companies approach nearshoring in Mexico. **A Vision for Collaboration** NMS brings a wealth of experience and a shared vision to Nearshore Mexico Sourcing. Herrera, with his deep understanding of Mexican culture, business practices, and regulatory frameworks, complements NMS's international business acumen and strategic planning expertise. Together, they have built a company that bridges the gap between foreign businesses and the vast opportunities available in Mexico. Their mission is simple yet impactful: to help companies unlock the potential of Mexico’s robust manufacturing sector, skilled workforce, and strategic geographic location. By offering end-to-end solutions, Nearshore Mexico Sourcing ensures that businesses can seamlessly integrate into the Mexican market and achieve their operational and financial goals. **Services Tailored to Success** Nearshore Mexico Sourcing offers a comprehensive suite of services designed to meet the unique needs of foreign companies: 1. **Supplier Development**: Mexico’s manufacturing sector is renowned for its quality and cost-effectiveness. NMS's team works closely with clients to identify, vet, and develop reliable suppliers that align with their specific requirements. This ensures a smooth supply chain and minimizes risks associated with sourcing in a new market. 2. **Project Management**: From concept to execution, Nearshore Mexico Sourcing provides expert project management services. Whether it’s setting up a new production facility or launching a product line, their team ensures that projects are completed on time, within budget, and to the highest standards. 3. **Soft Landing Services**: Transitioning into a new market can be daunting. Nearshore Mexico Sourcing offers soft landing services that include everything from legal and regulatory compliance to logistics and workforce recruitment. This allows companies to focus on their core business while the team handles the intricacies of establishing operations in Mexico. **Why Mexico?** Mexico’s strategic location, proximity to the United States, and extensive trade agreements make it an ideal destination for nearshoring. The country boasts a skilled labor force, competitive costs, and a thriving industrial ecosystem. Nearshore Mexico Sourcing leverages these advantages to help businesses maximize their return on investment while minimizing risks. **A Commitment to Excellence** What sets Nearshore Mexico Sourcing apart is its commitment to building long-term partnerships. NMS understands that success in a new market requires more than just transactional relationships. Their personalized approach ensures that clients receive the support and guidance they need to thrive in Mexico. **Looking Ahead** As global supply chains continue to evolve, Nearshore Mexico Sourcing is poised to play a pivotal role in helping businesses capitalize on the opportunities in Mexico. With NMS at the helm, the company is not just a service provider but a trusted partner in growth and innovation. For companies looking to expand their horizons, Nearshore Mexico Sourcing offers the expertise, resources, and dedication needed to turn challenges into opportunities. In the words of NMS, “Mexico is more than a location—it’s a gateway to success.”

Read More

Mexico, Nearshoring hotspot of 2024

Imagine a location in which robust domestic demand and ongoing economic growth are complemented by government investment in social programs and infrastructure. Mexico is this location in 2024 because of a number of factors coming together to drive the country's economy forward. Mexico is positioned to become an interesting opportunity for investors and progressive businesses, thanks to the country's nearshoring trend and steady growth. But what is causing this momentum, and how can you take advantage of Mexico's business opportunities? Let's take a deeper look at why businesses should strongly consider Mexico for their business growth and expansion. **What is Nearshoring** Nearshoring is a business strategy where companies outsource certain business processes or tasks to a nearby country rather than a distant one. This approach offers several advantages such as reduced costs compared to onshoring, while still maintaining geographical proximity which can facilitate communication, cultural alignment, and potentially quicker turnaround times. Nearshoring is often chosen to mitigate some of the challenges associated with offshoring, such as time zone differences, language barriers, and cultural disparities, while still benefiting from lower labor costs in nearby regions. **Increase of Nearshoring to the Americas** As opposed to the old trend of offshoring certain operations to Asia, the nearshoring of manufacturing and other operations from Asia to the Americas is one of the major trends propelling Mexico's economic growth. The following are some of the factors driving this trend: Artificial Intelligence: The rise of automation and artificial intelligence, which is making it more cost-effective to bring back manufacturing to the Americas. *Supply Chain Blues*: The pandemic revealed weak points in international supply chains, causing businesses to look for alternatives that are more durable and streamlined. Faster shipping times, fewer interruptions, and a stable environment are benefits of nearshoring to Mexico. *Cost Advantage*: Despite recent increases, labor costs in Mexico are still much lower than in the United States or Canada. For businesses looking to maximize their profits, this translates into alluring business opportunities. Mexico's Economic Outlook 2024 **The Mexican Advantage** *Strategic Location*: Mexico is a geographical goldmine for nearshoring companies due to its 2,000-mile border with the US, which facilitates effective cross-border trade and collaboration. Skilled Workforce: Mexico has 60 million skilled workers who have experience in a wide range of industries, including manufacturing, aerospace, and automotive. This talent pool is constantly expanding. This easily accessible human capital stimulates productivity and innovation. Stable Economy: In 2024, the Mexican economy is expected to expand by 2.6%, which will foster favorable investment conditions. This stability gives businesses looking to establish themselves in the area much-needed predictability and confidence. *Government Support*: By providing incentives, cutting red tape, and fostering an atmosphere that is business-friendly, the Mexican government is aggressively encouraging nearshoring. With this proactive stance, Mexico is positioned as a friendly location for nearshoring businesses. A favorable external environment: The global economy is expected to grow by 2.9% in 2024, which will benefit Mexico's export-oriented economy. *Favorable Business Climate*: Mexico offers competitive tax rates, attractive incentives, and a streamlined regulatory environment, making it easier for businesses to thrive. This pro-business approach makes Mexico an increasingly attractive investment destination. More about Tax Benefits in Mexico 2024 presents a window of opportunities for Mexico to capitalize on the nearshoring wave. By addressing the existing challenges and leveraging its advantages, Mexico can solidify its position as the 2024 Nearshoring Hotspot. Companies considering nearshoring should carefully assess their needs, conduct thorough due diligence, and partner with reliable local experts to navigate the landscape. Nearshore Mexico Sourcing can help you with your nearshoring journey. By working together, we can ensure a smooth and successful path to shared prosperity.

Read More

Cuales sectores están aprovechando las oportunidades del Nearshoring en manufactura (Español)

2020 no sólo trajo una pandemia global que golpeó la economía mundial, sino que también dejó reflexiones importantes sobre la fragilidad de la cadena de valor global. Así, la manera en que los sectores de manufactura respondan a esta situación podría marcar su propio futuro y el de la región del mundo donde desarrollan sus negocios. En este contexto, varias empresas trasnacionales han decidido mover su producción para protegerse ante interrupciones de proveeduría, así como para reducir su dependencia a zonas industriales de ultramar como Wuhan (China), lugar de origen del coronavirus SARS-CoV-2. Y aunque ningún país es inmune a sufrir perturbaciones en su ecosistema de producción y logística, México detonó su atractivo como centro de manufactura clave en América del Norte debido a tres situaciones: La entrada en vigor del renovado Tratado México-Estados Unidos-Canadá (T-MEC, antes TLCAN), que dio certeza a los intercambios comerciales y ratificó la preferencia arancelaria para fabricantes establecidos en territorio mexicano. Las tensiones comerciales entre China y EUA y su guerra de aranceles vigente desde 2018. Las ventajas logísticas del país en términos de tiempos y costos de traslado (vía tren o carretera), comparado con los 30-40 días que toma un buque asiático en tocar costas de California. A estos factores se suma el boom mundial del comercio electrónico derivado de las medidas de prevención de contagios y distanciamiento social, y que sigue impulsando la demanda de espacios industriales. Todo esto se conjuga para que, según opiniones recabadas por NAIOP, Asociación de Propiedades Industriales y Comerciales de los EU, algunos fabricantes en México se atrevan a proclamar que “(link: https://blog.naiop.org/2020/07/nearshoring-and-other-manufacturing-shifts-for-the-post-covid-19-world/ text: los beneficios de producir en Asia se acabaron)”, y el nearshoring (relocalización de la producción al país más cercano al mercado de consumo) es la inversión más conveniente tanto por costos como por calidad de manufactura. Sigue leyendo y explora los sectores más beneficiados. ## Nearshoring y manufactura: sectores más beneficiados La industria manufacturera en México es una de las más competitivas del mundo pues, además de ofrecer mano de obra y costos bajos, tiene tecnología y alta calidad. Además, en las últimas décadas se ha incrementado la presencia de fabricantes de equipo original (OEM por sus siglas en inglés), que junto con sus proveedores han establecido plantas en territorio mexicano a fin de aprovechar ventajas estratégicas como: ubicación, amplia infraestructura logística y cadenas de suministro y de exportación consolidadas. Así, los principales clústeres de la industria manufacturera que se benefician del nearshoring en México son de los siguientes sectores: 1. Automotriz y autopartes. 2. Aeroespacial. 3. Dispositivos médicos. 4. Farmacéutico. 5. Electrónica y electrodomésticos. 6. Tecnologías de la información y la comunicación (TIC). ## Automotriz y autopartes En los últimos 10 años, la producción y ventas de la industria automotriz mexicana aumentaron a niveles exponenciales, con un 80% de los vehículos de exportación con destino a los socios de México en el T-MEC, Estados Unidos y Canadá. Además, nuestro país está entre los principales proveedores de partes y componentes en el mundo, es líder global en producción de camiones y vehículos especializados y, por si fuera poco, armadoras como Mercedes-Benz, Volkswagen, Audi, FCA, Hyundai, Mazda, Toyota, Kia, Nissan y Ford han instalado plantas en varias regiones del país. Esto representa oportunidades específicas dependiendo la zona del país, siendo las más importantes: - **Frontera norte.** Cerca del 81% de la producción automotriz de exportación se concentra en 12 zonas metropolitanas del norte de México, incluyendo Tijuana, Hermosillo, Chihuahua y Monterrey. - **Centro-Bajío-Occidente.** Guanajuato, Aguascalientes, Querétaro, Jalisco, San Luís Potosí y Zacatecas concentran un alto número de OEM, así como de proveedores Tier 1 y Tier 2. - **Puebla, Estado de México y Veracruz.** El Centro-Oriente del país ha atraído a fabricantes internacionales de autopartes, elevando su participación en la cadena logística y de proveeduría del sector con corredores industriales destacados como Toluca-Lerma. ## Aeroespacial Los principales clústeres aeroespaciales en México se encuentran en Sonora, Baja California, Chihuahua, Nuevo León y Querétaro. Cada uno de ellos tiene su propia especialización, cadenas de suministro desarrolladas y fuertes vínculos con comunidades, gobiernos e instituciones académicas (la llamada “cuádruple hélice”). Así, el ecosistema aeroespacial mexicano ha crecido año con año, lo que le ha valido recibir más de 3 mil 400 millones de dólares de inversión extranjera directa (IED) durante el periodo 1999-2020. Los países que más invierten en el sector son Estados Unidos (63.9%), Canadá (24.6%) y Francia (7.4%). ## Dispositivos médicos En México hay 8 clústeres principales de prótesis e instrumental médico y quirúrgico, el más grande ubicado en el estado de Baja California y conformado por arriba de 60 empresas. El mercado estadounidense es el principal destino de las exportaciones de esta industria, tercera potencia exportadora a nivel mundial. ## Farmacéutico México cuenta con una de las industrias farmacéuticas más desarrolladas de la región, con más de 200 empresas incluyendo reconocidas firmas multinacionales. Aunque los clústeres más grandes se encuentran en Ciudad de México y Jalisco, el Estado de México, Puebla y Michoacán también tienen una huella importante. Y en 2021, el estado Hidalgo firmó convenios con 6 productores de la India para impulsar un nuevo clúster de medicamentos genéricos. ## Electrónica y electrodomésticos México cuenta con 8 y 6 clústeres de fabricación de aparatos electrónicos y electrodomésticos, respectivamente, repartidos a todo lo largo y ancho del país. Baja California, Coahuila, Nuevo León y Estado de México son los estados con mayor presencia de fabricantes de ambos sectores, que realizan exportaciones a todo el mundo. ## Tecnologías de la información y la comunicación (TIC) Con un valor de 13 mil 700 millones de dólares, México tiene el segundo sector tecnológico más grande de Latinoamérica, sólo detrás de Brasil. En 2018, México fue el 2° exportador de dispositivos para transmisión/recepción de voz, imágenes u otros datos, incluyendo dispositivos de comunicación inalámbrica o radio (excepto celulares). Sus principales destinos de exportación fueron Estados Unidos, Hong Kong, Malasia, China e Israel. ## T-MEC: impulso a las inversiones de manufactura A la fortaleza de cada rama manufacturera y las ventajas productivas de México se suma la certidumbre del T-MEC, que refuerza la relación trilateral del anterior TLCAN y al mismo tiempo crea nuevas oportunidades de inversión con disposiciones como: 1. Acceso libre de impuestos al mercado mexicano. Al invertir en operaciones de ensamblaje y manufactura ligera, fabricantes extranjeros obtienen reducción de costos, menos trámites y previsibilidad en transacciones transfronterizas. 2. Reglas de origen. OEM y proveedores se benefician de los aumentos al valor de contenido regional de 75% en automóviles y 70% en camiones ligeros y pesados, respectivamente. Además, las disposiciones relativas al contenido laboral e investigación y desarrollo van más allá de las reglas de origen de acuerdos comerciales tradicionales. 3. Seguridad para la inversión. El T-MEC ofrece un marco jurídico transparente, predecible y propicio para las inversiones, incluyendo mecanismos para la solución de controversias. 4. Comercio de servicios. El texto del T-MEC establece que las Partes no impondrán barreras que distorsionen el intercambio transfronterizo de servicios (por ejemplo, la obligación de tener una oficina física). 5. Comercio digital. El capítulo 19 del T-MEC establece que los productos digitales transmitidos vía electrónica serán libres de impuestos, y reconoce el valor de las plataformas digitales para mejorar la disponibilidad de bienes y servicios, entre otras ventajas. 6. Protección de la propiedad intelectual. El T-MEC garantiza la transparencia y la protección de patentes e innovaciones tecnológicas mediante un marco jurídico completo. << (link: https://blog.frontierindustrial.mx/nearshoring-en-mexico-ventajas-ahorros text: Nearshoring en México: ventajas y ahorros para empresas extranjeras) >> En Nearshore Mexico Sourcing respaldamos las oportunidades de negocio que se generan a través del *nearshoring* en México y la regionalización de las cadenas de suministro. Por eso, nuestro portafolio industrial ofrece servicios de Sourcing en Mexico.

Read More

Mexico: Country with the Greatest Nearshoring Potential in The Americas

**Mexico’s strategic location, excellent connectivity, and long history of openness to trade have made it the top choice in North America for international companies looking to expand their operations to areas with competitive costs and market access.** Now, with the entering into force of the new USMCA and companies looking to diversify their supply chains, Mexico is prepared for a boom in nearshore and offshore manufacturing for exporters from North American and around the world. Its strategic location is one of the main reasons it offers some of the world’s most competitive costs for companies looking to start up manufacturing services in Mexico. This, added to the additional certainty for investors provided by the new and updated trade agreement that went into effect in July aimed at strengthening the North American supply chain, makes it is the obvious choice for manufacturers in a range of industries.  Another important factor making it attractive for companies looking at setting up nearshore or offshore manufacturing in Mexico is the country’s excellent connectivity. **The transport of manufactured goods from Mexico to any point in the USA takes about 24 hours, **equating to shorter delivery times, less risks and lower costs than other low-cost countries. Its geographic location and little or no difference in time zones also make it easy to closely monitor manufacturing processes. Besides being neighbor to one of the largest markets in the world, with which it has 54 border crossings to the United States, it also has direct access to central and south America and both the Atlantic and Pacific Oceans. Internally, Mexico boasts over 80,000 miles of highways and trade routes, further facilitating the movement of goods to any place in the world by air or sea. **It is also the 3rd country with the most airports globally and 3rd most railroads in Latin America.**  All these factors, combined with its long history of openness to trade as a way to expand and diversify its economy, give Mexico preferential access to around 50 markets. This policy of openness to trade is reflected in its 13 free trade agreements (FTAs) and nine economic complementation agreements and partial scope agreements, in addition to 32 agreements for the promotion and reciprocal protection of investments (APPRIs) with 33 countries. As a result, Mexico is one of the world’s top 15 exporters, exporting a total of US$387 billion annually. Over the last six years, foreign direct investment in Mexico has remained stable, between US$30 and 35 billion. **More than 47% of the country’s inward FDI has been channeled towards advancing manufacturing industries and manufacturing 4.0, making it one of the most attractive countries for FDI.** Geographic location, connectivity, and a culture of openness to trade are three of the most important factors making it the perfect place to set up operations. If your company is interested in manufacturing in Mexico, find out more about if the move is right for your company by contacting a provider of shelter services in Mexico.

Read More

Nearshore Mexico Sourcing – Help Businesses With Sourcing Services

Why is Nearshore (link: http://www.nearshoremexicosourcing.com/ text: Mexico Sourcing) Better? Here are four main reasons. Less expensive, faster, and more flexible. And it’s all legal! Here are the pros and cons of Nearshore Mexico Sourcing for your next product or service. Sourcing products from Mexico is easier than ever before. Listed below are some of the key benefits of Nearshore Mexico Sourcing. Read on to find out which one is right for you. ## Less expensive The proximity of Mexico to the United States has many advantages for international manufacturers. Not only is the cost of labor and shipping significantly lower, but Mexican manufacturers have better access to a wider range of suppliers. Because Mexican suppliers can better understand your processes and can react quickly to changes, international companies can more easily categorize them by spend and revenue impact. They can also control their inventory and ship products to end consumers in the United States. Because of its close proximity to the United States, nearshore sourcing to Mexico is a more attractive choice for American companies. For example, Mexico is an ideal partner for projects where collaboration and communication are critical. The close proximity makes it easier for teams to communicate with workers at manufacturing facilities. And traveling to Mexico is cheap compared to hiring people across the world. The cost of a dedicated development team in Mexico can also be lower. In addition, some nearshore software development services provide staff augmentation. ## Faster If your company is looking to outsource some or all of its software development processes, Mexico is a great choice. Nearshore Mexico sourcing partners share a common language, culture, and goals with Americans. Their staffs are familiar with the business and consumer cultures of the United States. Additionally, many nearshore contractors speak both English and Spanish. This ease of communication helps build rapport and teamwork. In addition, Mexico has a low cost of labor compared to many U.S. locations. When it comes to nearshoring manufacturing to Mexico, companies benefit from low-cost factory premises and a strong IP protection regime. IP protection is also stronger in Mexico than in many Asian countries. Mexico also continues to invest in infrastructure and improved links with neighboring countries, which increases the potential for overall operational cost savings. Intran’s skilled workforce, for example, ensures high quality for complex product manufactures at a lower cost. ## More flexible Nearshore sourcing in Mexico offers many advantages. Not only is the cost of production lower than the US, but the IP protection is much stricter in Mexico than in some of the neighboring Asian countries. Additionally, the proximity of Mexico to the US makes it easier to find and hire skilled labor. Although there are certain risks, nearshore (link: http://www.nearshoremexicosourcing.com/ text: Mexico sourcing agent) can save companies money on both labor costs and infrastructure expenses. In this article, we’ll discuss the advantages of nearshore Mexico sourcing and how to benefit from it. Another advantage of sourcing from Mexico is its proximity to the US. Nearshore Mexico offers international companies a competitive advantage over China. The country is closely aligned with US time zones, which allows companies to track customer behavior, respond to changes in supply and demand, and trace the supply chain. In short, it’s a win-win scenario for multinational companies. The benefits of nearshore Mexico sourcing are clear. ## Better There are many advantages to Nearshore Mexico sourcing. In addition to its proximity to the U.S., Mexico’s English-speaking population provides excellent technical skills and a strong work ethic. Those factors, coupled with Mexico’s lower cost, make it an attractive destination for software outsourcing. Here are the top three reasons to consider Nearshore Mexico sourcing for your next project. You’ll have more time to focus on business development, and lower travel expenses. ## Conclusion: The proximity to the United States allows companies to hire a qualified nearshore development team. Not only is Mexico close to the US, but its time zone is also the same. This makes conference calls quick and easy to set up. Furthermore, Mexico’s skilled workforce is highly qualified for manufacturing complex products. In addition, the proximity to the US means fewer time differences, a crucial consideration when selecting a nearshore development team.

Read More

Nearshoring puede fortalecer lazos comerciales entre México y Asia (Español)

Con la tendencia del nearshoring y tratados como el TPP, la relación entre México y Asia debería fortalecerse en el largo plazo. Más que deteriorar los lazos comerciales de México y Asia, la tendencia del nearshoring podría mejorar su relación a futuro. Tanto el (link: https://www.forbes.com.mx/las-empresas-que-dejan-asia-generaran-medio-millon-de-empleos-en-mexico-se/ text: Gobierno federal) como (link: https://www.eleconomista.com.mx/economia/Si-hay-empresas-que-quieran-pasar-de-Asia-a-America-Latina-el-BID-les-financia-el-viaje-Claver-Carone-20211227-0088.html text: agentes internacionales) esperan que operaciones y actividades productivas que ahora se encuentran en Asia, comiencen a trasladarse a México en el transcurso de los próximos años, en una apuesta por acortar las cadenas de suministro y tener un mejor acceso al mercado norteamericano. Esta tendencia de nearshoring está motivada en parte por la guerra comercial que inició entre Estados Unidos y China durante la administración de Donald Trump, así como por las disrupciones logísticas causadas en la pandemia. Sin embargo, expertos han destacado (link: https://macrofab.com/blog/nearshoring-trend-will-mexico-win-over-china/ text: varias ventajas) de México respecto a producir en Asia, incluyendo beneficios en materia laboral y logística. En este contexto, la conversación generalmente se ha dado en términos de (link: https://www.supplychainbrain.com/blogs/1-think-tank/post/32683-the-near-shoring-trend-will-chinas-loss-be-mexicos-gain text: suma-cero), donde lo que gane México en actividad comercial lo perderán Asia y China por la fuga de actividades comerciales. Pero los especialistas en comercio exterior están confiados que la tendencia del nearshoring llevará a un fortalecimiento de las relaciones entre México y Asia. “Lo que se está buscando es traer parte de la producción de Asia a nuestro país, para tener más seguridad en las cadenas de suministro y de producción […]. Y mucha de la inversión es con capital chino. La relación con Asia sigue y se fortalece. Hay una empresa que se está estableciendo en Monterrey y que tienen un capital mayormente chino, que busca establecerse en México precisamente para atender el mercado americano”, apunta Fernando Ruiz Huarte, director general del Consejo Mexicano de Comercio Exterior, Inversión y Tecnología (Comce). Asimismo, no es que México pueda convertirse en un sustituto perfecto de la producción que existe en Asia. Hay muchas industrias que aún no tienen una presencia fuerte en el país y que (link: https://www.arenapublica.com/negocios/complejo-que-nearshoring-traiga-nuevas-industrias-mexico text: requerirán años para poder desarrollarse), por lo que seguirá siendo atractivo para muchos corporativos que atienden al mercado norteamericano mantenerse en China y en países cercanos. También se espera que la relación de proveedor-cliente entre Asia y México se mantenga y crezca en el largo plazo, aún con la tendencia del nearshoring. Entre enero y marzo de este año, el valor de la relación comercial de México con Asia (la suma del valor de las (link: https://www.banxico.org.mx/SieInternet/consultarDirectorioInternetAction.do?sector=1&accion=consultarCuadro&idCuadro=CE85&locale=es text: importaciones) y las (link: https://www.banxico.org.mx/SieInternet/consultarDirectorioInternetAction.do?sector=1&accion=consultarCuadro&idCuadro=CE86&locale=es text: exportaciones)) fue de 61 mil 702 millones de dólares (MD), según cifras del Banco de México. Lo anterior representa 9.7% del valor total de todas las transacciones de México con el resto mundo. Sin embargo, el (link: https://www.banxico.org.mx/SieInternet/consultarDirectorioInternetAction.do?sector=1&accion=consultarCuadro&idCuadro=CE87&locale=es text: saldo) de la balanza comercial México-Asia es profundamente deficitario, con un valor de 31 mil 590 MD durante el primer trimestre del 2022. Lo anterior se debe a que México importa una cantidad importante de materias primas, bienes intermedios y productos semi-terminados que se procesan localmente y luego se envían a otros mercados. Esta dinámica de proveedor-cliente continuaría y hasta se expandiría con el nearshoring. “El mercado va a seguir creciendo, manteniendo las dinámicas que hemos visto hasta ahora […]. Ahorita compramos muchos insumos de China […] y va a seguir manteniéndose esa balanza negativa, porque vamos a continuar como grandes consumidores y procesadores de productos chinos”, dice Jorge Luis Moreno Félix, Managing Director de Deals en PwC. Pero otros especialistas esperan que el momento del nearshoring, junto con las ventajas que traen tratados como el acuerdo Transpacífico (TPP), abra la puerta a que México equilibre y hasta le dé la vuelta a la naturaleza de su balanza comercial con Asia. “Podrías generar más actividad con Asia, la región que será la de más crecimiento económico y de ingreso per cápita de aquí al 2040 […]. Ahí tienes a Japón, Vietnam, Singapur […], Corea del Sur ha dicho que presentará su solicitud", dice Jorge Molina Larrondo, consultor en políticas públicas y análisis de riesgo y catedrático del Tec de Monterrey (ITESM). "[Con el TPP] México podría desarrollar oportunidades [de exportar productos al extranjero] que se están volviendo más difíciles de desarrollar con Estados Unidos”, plantea Molina Larrondo.

Read More

Doing business in Mexico